The net working capital formula is calculated by subtracting the current liabilities from the current assets. The real challenge faced when calculating net working capital is determining which assets and liabilities are classified as current, instead of long-term. Incorrectly classifying long-term assets (like property) as current, for example, can cause a company’s NWC to be artificially positive and will suggest the company is more liquid than it actually is. Therefore, as of March 2024, Microsoft’s working capital metric was approximately $28.5 billion.

- Net working capital uses a simple formula that makes it easy to determine whether a company is capable of meeting it’s short-term financial obligations.

- However, if working capital stays negative for an extended period, it can indicate that the company is struggling to make ends meet and may need to borrow money or take out a working capital loan.

- If the purchasing department opts to buy larger quantities at one time, it can lower unit prices.

- The change in net working capital is pivotal for managing liquidity, strategic planning, and operational management.

- For example, if a company has $1 million in cash from retained earnings and invests it all at once, it might not have enough current assets to cover its current liabilities.

- You calculate working capital by subtracting current liabilities from current assets, providing insight into a company’s ability to meet its short-term obligations and fund ongoing operations.

- By following these steps, you can accurately calculate your net working capital and then determine any changes over time.

How can a company improve its Net Working Capital?

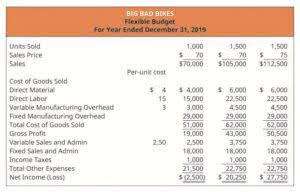

For instance, if a company has current assets of $100,000 and current liabilities of $80,000, then its working capital would be $20,000. Common examples of current assets include cash, accounts receivable, and inventory. Examples of current liabilities include accounts payable, short-term debt payments, or the current portion of deferred revenue. Changes in Net Working Capital is a financial concept that refers to the change in a company’s current assets minus its current liabilities over a certain period of time. It’s an important component of a company’s cash flows and is used to measure a company’s short-term liquidity over time. An increase or decrease in a company’s net working capital indicates whether the company has enough short-term net working capital change assets to cover its short-term debt.

How to Find Change in NWC on Cash Flow Statement (CFS)

- Working capital, often referred to as the lifeblood of a business, represents the funds available for day-to-day operations.

- It’s worth noting that while negative working capital isn’t always bad and can depend on the specific business and its lifecycle stage, prolonged negative working capital can be problematic.

- Both figures can be found in public companies’ publicly disclosed financial statements, though this information may not be readily available for private companies.

- In addition, the liquidated value of inventory is specific to the situation, i.e. the collateral value can vary substantially.

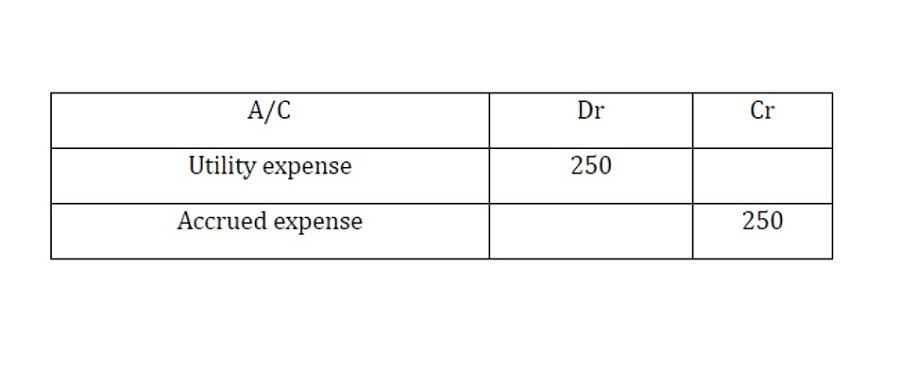

- An increase in net working capital is subtracted from the net income while a decrease is added to it.

- Once the remaining years are populated with the stated numbers, we can calculate the change in NWC across the entire forecast.

- Tracking changes in Net Working Capital is important because it gives a clear picture of a company’s short-term liquidity and operational efficiency.

As a result, the company’s net working capital increases, reflecting improved liquidity and financial strength. It indicates that Walmart’s current liabilities increases or https://www.facebook.com/BooksTimeInc/ the company have successfully stretched its account payable days. Understanding how to calculate and interpret net working capital is fundamental for effective financial management and decision-making within a business. The final net working capital figure, in this case, $405,000, provides valuable insights into your business’s financial condition.

How Do You Calculate Working Capital?

- Changes in working capital can occur when either current assets or current liabilities increase or decrease in value.

- We can see current assets of $97.6 billion and current liabilities of $69 billion.

- If a company’s change in NWC has increased year-over-year (YoY), this implies that either its operating assets have grown and/or its operating liabilities have declined from the preceding period.

- She has over 2 years of experience in writing about accounting, finance, and business.

A company with positive working capital generally has the potential to invest in growth and expansion. But if current assets don’t exceed current liabilities, the company has negative working capital, and may face difficulties in growth, paying back creditors, or even avoiding bankruptcy. It’s a commonly used measurement to gauge the short-term financial health and efficiency of an organization. Items affecting working capital include any changes in current assets and current liabilities. Current assets include cash (and cash equivalents), marketable securities, inventory, accounts receivable, and prepaid expenses.

Working capital is a snapshot of a company’s current financial condition—its ability to pay its current financial obligations. Cash flow looks at all income and expenses coming in and out of the company over a specified time period, providing you with the big picture of inflows and outflows. As the different sections of a financial statement impact one another, changes in working capital affect the cash flow of a company. In the above picture, the highlighted part represents the total current liabilities of Walmart Inc which are due within a one-year time https://www.bookstime.com/ duration. Here, the total current liabilities for the year and 2019 is $77,790 million and $77,477 million respectively. Finally, you subtract any other financial obligations considered liabilities, such as employee wages, interest payments, and short-term loans that will come due within the next year.

Current Assets

The net working capital in the example above is 1.67, which represents a “positive” NWC. In most cases, this would indicate it is in a liquid, financially stable position. Cash flow is the net amount of cash and cash-equivalents being transferred in and out of a company. The Net Working Capital Ratio is like a measuring tape for a business’s short-term money compared to everything it owns. The interpretation of either working capital or net working capital is nearly identical, as a positive (and higher) value implies the company is financially stable, all else being equal.